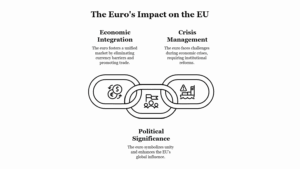

The Euro, the official currency of the Eurozone, comprising 20 out of the 27 European Union (EU) member states, has established itself as one of the most important currencies in the world, alongside the U.S. Dollar. Introduced in 1999 as an electronic currency and in 2002 as banknotes and coins, the Euro has not only revolutionized the European economy but also reshaped global financial dynamics. Its role in the world economy, coupled with its implications for India, provides a compelling subject for analysis.

1. Role of the Euro in the World Economy

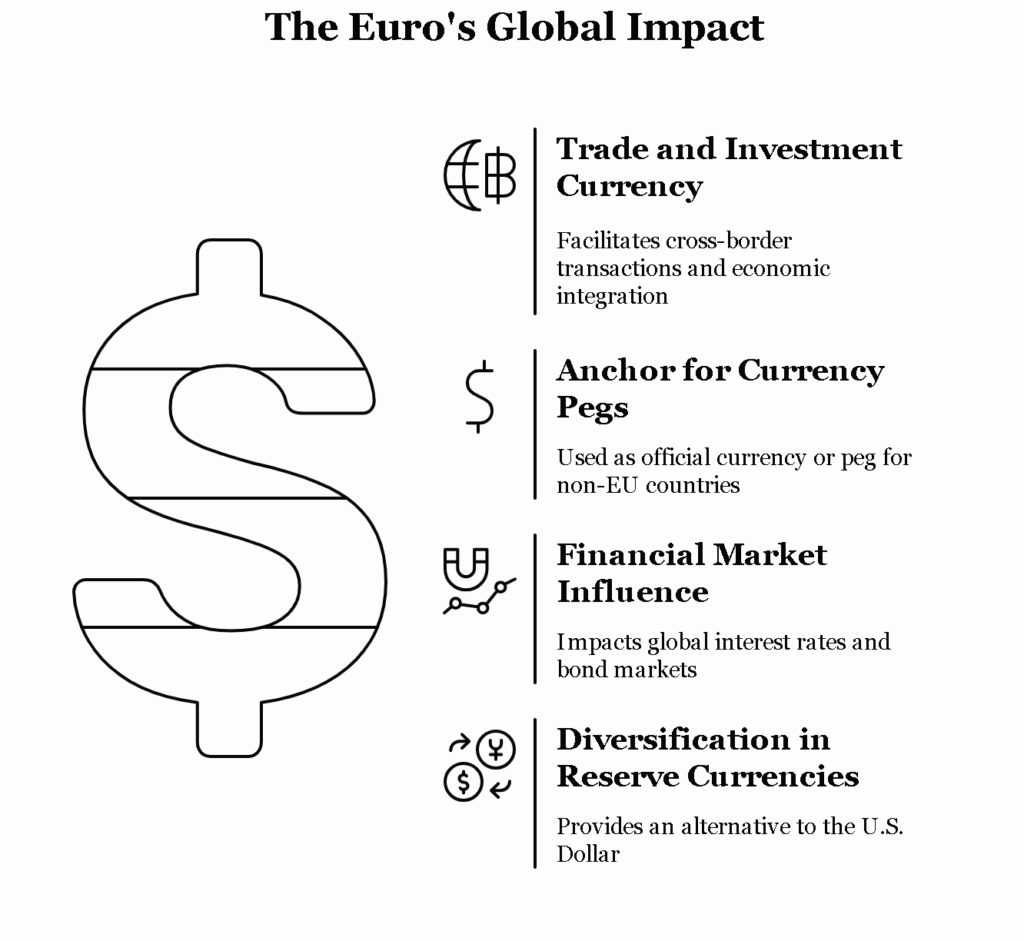

The Euro’s primary role is as a global reserve currency, second only to the U.S. Dollar. As of 2023, about 20% of global foreign exchange reserves are held in Euros, a significant portion compared to the dollar’s dominance. The Euro is widely used in international trade and finance, becoming a preferred currency for transactions within and outside the EU. This has led to several critical roles for the Euro in the global economy:

- Trade and Investment Currency:

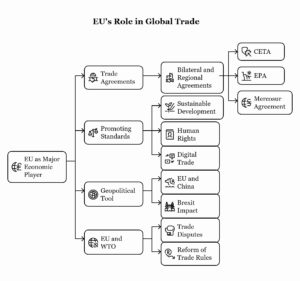

The Euro is the second most traded currency globally. It facilitates cross-border transactions within the Eurozone and with other countries, including many in Africa, Asia, and Latin America. The common currency eliminates currency risk and exchange rate fluctuations, offering more stability for businesses and investors within the Eurozone. It has strengthened the EU’s economic integration and global competitiveness. - Anchor for Currency Pegs:

Several countries outside the EU, including Kosovo, Montenegro, and some nations in Africa, use the Euro as their official currency or peg their currency to the Euro. This is a testament to the trust and influence the Euro holds globally. Additionally, the European Central Bank (ECB), which is responsible for managing the Euro, plays a significant role in shaping global monetary policy through its policies on inflation control and interest rates. - Financial Market Influence:

The Euro is critical in global financial markets. European bond markets, especially Euro-denominated sovereign bonds, are among the most significant in the world. The Euro Area also plays a pivotal role in determining global interest rates, with the European Central Bank (ECB) influencing short-term rates that have an impact on capital flows and financial investments. - Diversification in Reserve Currencies:

The Euro has provided an alternative to the dominance of the U.S. Dollar in the international monetary system. Countries looking to diversify their foreign exchange reserves have increasingly turned to the Euro. For example, countries like China, Russia, and several oil-exporting nations have diversified into Euro-denominated assets.

2. Implications of the Euro for India

The Euro’s role in the world economy has important implications for India, affecting several key aspects of its economic, trade, and financial strategies.

- Trade Relations and Exports:

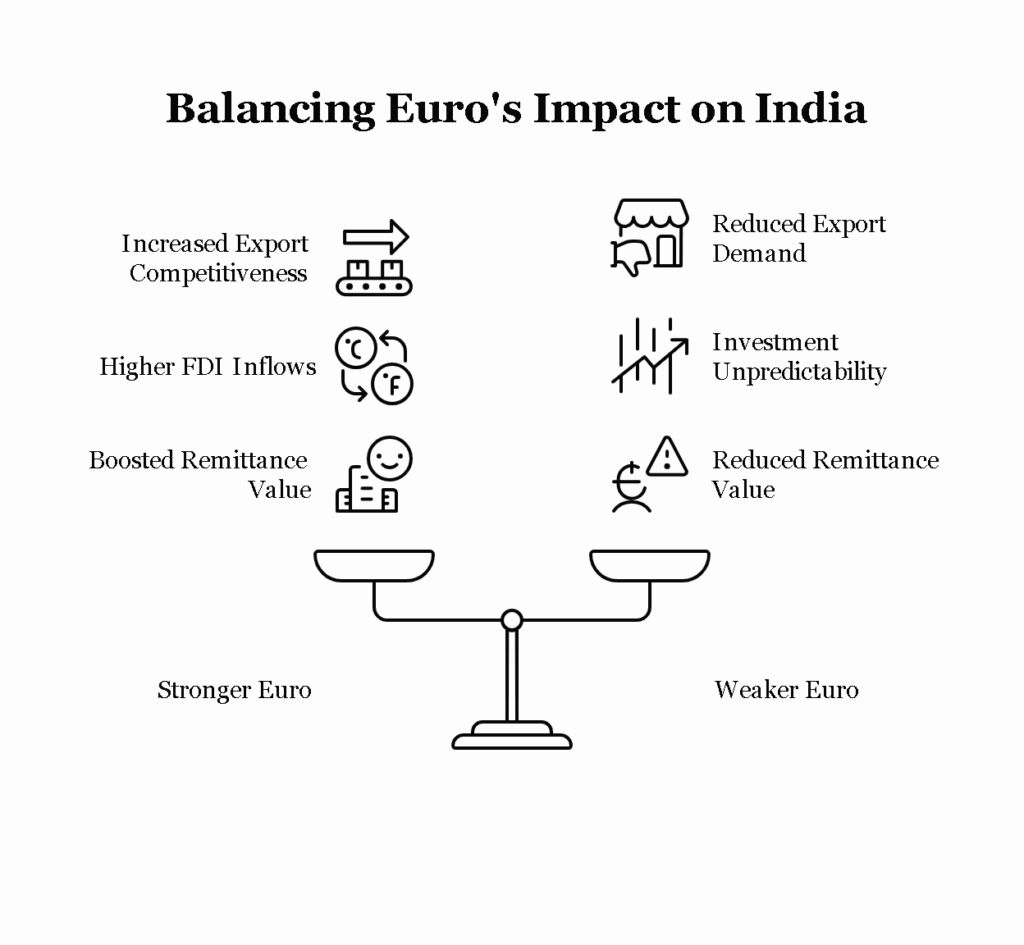

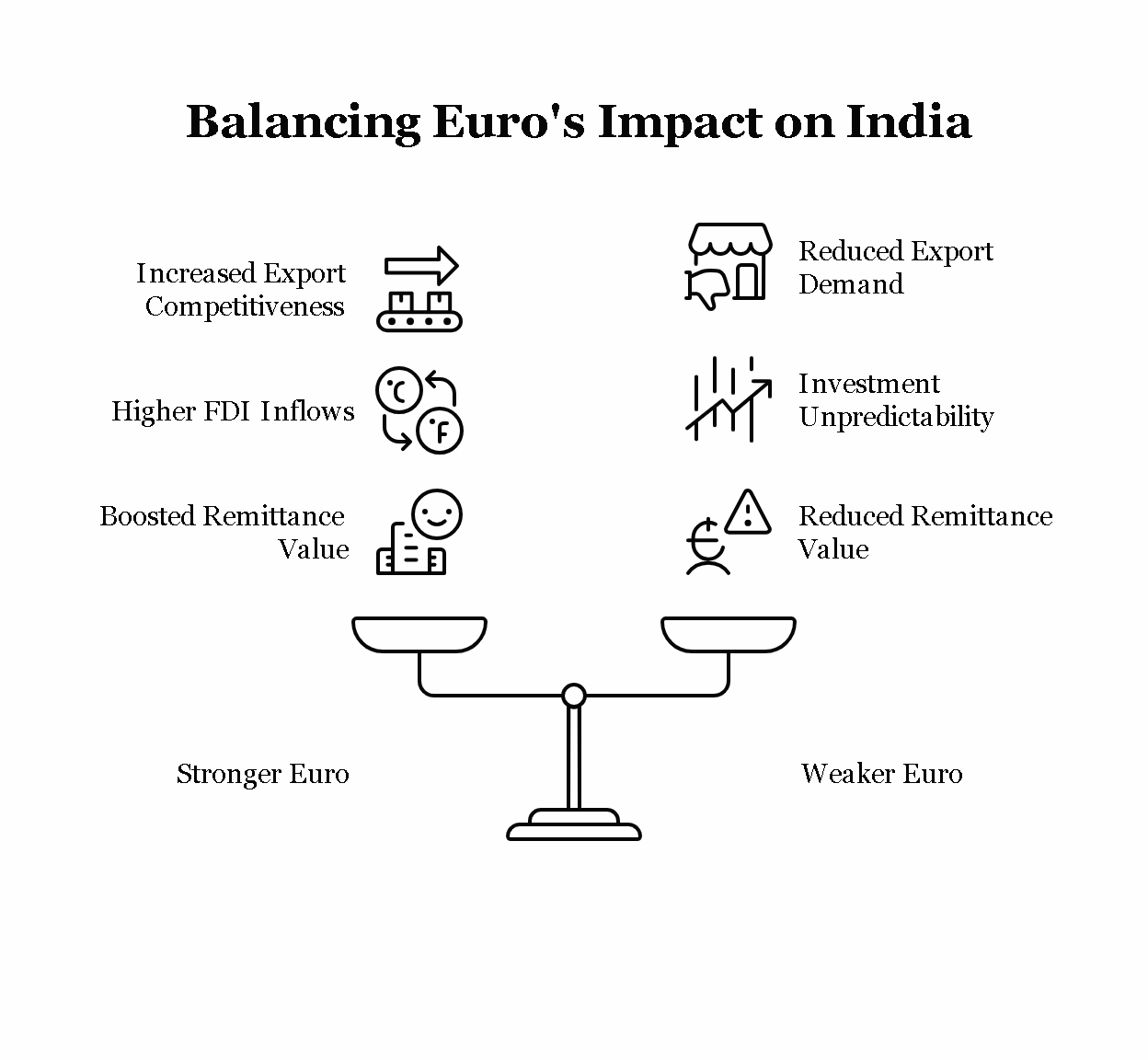

India is a major trade partner with the EU, with trade relations spanning various sectors, including pharmaceuticals, automobiles, textiles, IT services, and agriculture. As the Euro is the currency of the Eurozone, fluctuations in the Euro’s value directly impact India’s exports to EU countries. A stronger Euro benefits Indian exporters, as it increases the purchasing power of consumers in the Eurozone, making Indian products more competitive. Conversely, a weaker Euro can reduce demand for Indian exports, as the purchasing power in the EU declines. - Investment Flows:

The Eurozone is one of India’s largest sources of foreign direct investment (FDI). A stable and strong Euro contributes to higher FDI inflows from the EU, as investors find a robust European currency more attractive for investment. Euro-denominated funds also facilitate better capital flows for Indian companies in the European market. Conversely, Euro volatility can lead to unpredictability in investment, which can negatively affect Indian companies and their projects in the Eurozone. - Financial Market Stability and Risks:

The Euro’s role in global financial markets means that fluctuations in its value against the U.S. Dollar, Indian Rupee (INR), and other currencies can influence exchange rates, impacting India’s external trade, tourism, and remittances. The Rupee-Euro exchange rate is particularly important for Indian businesses, especially those that deal with the European market. A depreciation of the Euro could increase the cost of imports from the Eurozone, leading to higher inflationary pressures in India. - Indian Remittances:

India is the largest recipient of remittances globally, and a substantial portion of these remittances comes from the European Union. A strong Euro boosts the value of remittances received by Indian families, as workers in the EU send more money home. However, a weakened Euro reduces the amount received, affecting the standard of living for recipients and potentially influencing consumption patterns in India. - Energy Prices and Inflation:

Many energy transactions, especially oil and gas, are conducted in U.S. Dollars, but Euro-denominated transactions are also common, particularly in European and African markets. Therefore, fluctuations in the Euro-Dollars exchange rate can indirectly influence global energy prices, which, in turn, affect India’s import costs for oil and gas. This impacts India’s energy security and overall inflation rates.

3. The Euro and India’s Global Positioning

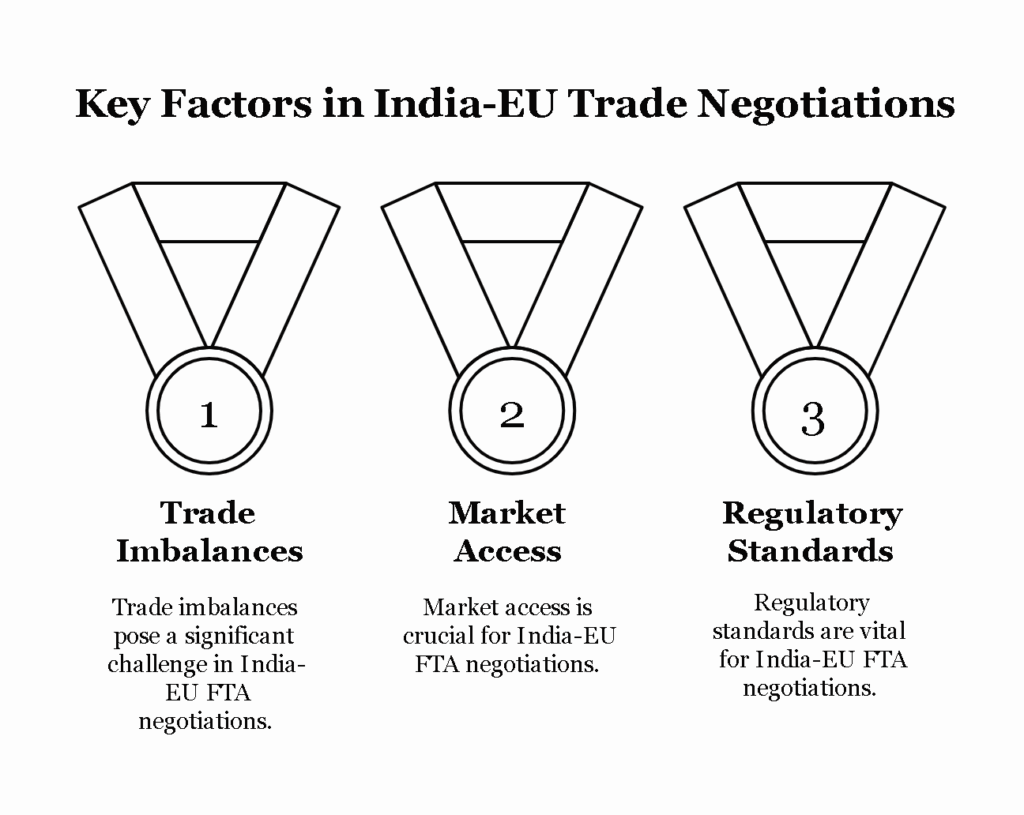

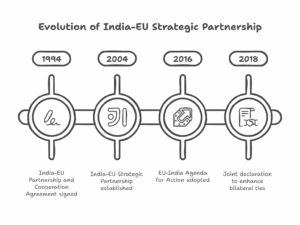

The Euro’s global significance also impacts India’s strategic positioning in global economic forums. As the Euro is a significant player in multilateral trade negotiations and international financial institutions, India must align its policies to navigate the Eurozone’s economic challenges and opportunities. This is especially important in the context of India-EU Free Trade Agreement (FTA) negotiations, where both parties seek to resolve issues like trade imbalances, market access, and regulatory standards.

Conclusion:

The Euro’s role in the world economy is substantial, acting as a global reserve currency, an anchor for financial markets, and a key factor in international trade. For India, the Euro’s strength and stability have direct implications on trade, investment, remittances, and financial markets. While the Euro’s integration has brought about greater economic stability within the EU, it has also presented both challenges and opportunities for India, making it essential for Indian policymakers to monitor and adapt to changes in the Eurozone’s economic landscape.

Leave a Reply