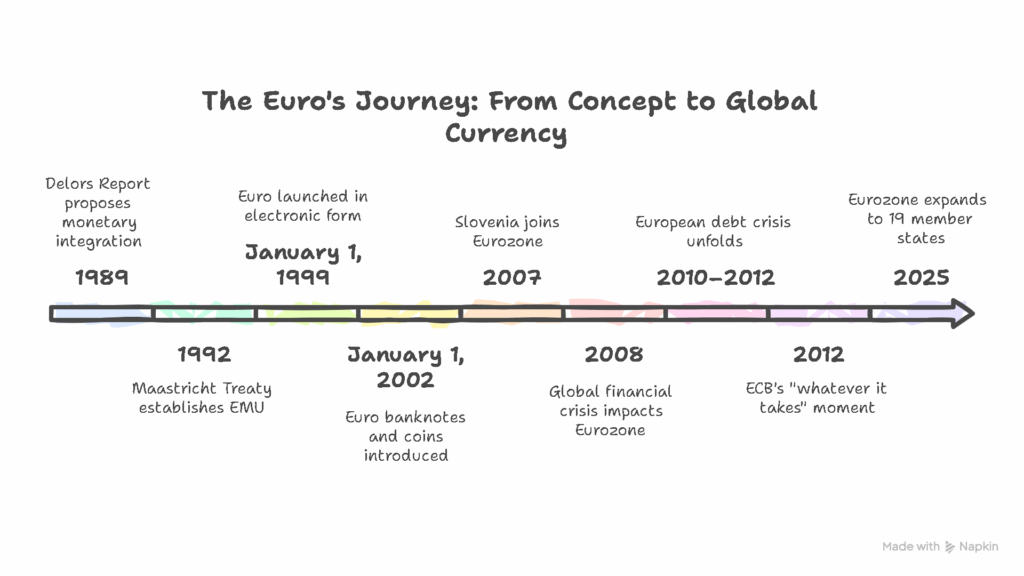

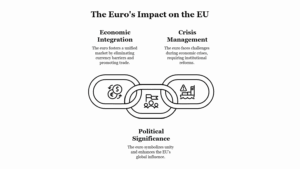

The Euro is the official currency of the Eurozone, a group of European Union (EU) member states that have adopted it as their primary means of exchange. Since its introduction, the Euro has undergone several key developments, from its conception and establishment to its current status as one of the world’s most significant currencies. Below, we examine the major developments in the evolution of the Euro, considering the economic, political, and institutional milestones that have shaped its journey.

I. The Conceptualization and Founding of the Euro

- The Maastricht Treaty (1992):

- The concept of a single European currency was first formally established with the Maastricht Treaty, signed in 1992. The treaty laid the groundwork for the Economic and Monetary Union (EMU), which aimed to integrate EU economies more closely through a shared currency.

- The Maastricht Treaty set out the conditions for the creation of a single currency, focusing on three key criteria for EU member states: price stability (inflation control), sound public finances (budget deficit and debt limits), and exchange rate stability.

- These criteria were designed to ensure that the economies of participating countries were sufficiently aligned to make the transition to a common currency viable.

- The Delors Report (1989):

- Prior to the Maastricht Treaty, the Delors Report (1989) proposed the gradual steps to monetary integration within the EU, culminating in the introduction of the Euro.

- The report recommended the establishment of a European Central Bank (ECB) and the creation of the Euro, advocating for the need for a single currency to facilitate free trade, reduce transaction costs, and enhance the EU’s global economic competitiveness.

II. The Launch of the Euro (1999–2002)

- The Introduction of the Euro in Electronic Form (1999):

- The **Euro was officially launched on January 1, 1999, but it initially existed only in electronic form. This meant that the currency was used for electronic transfers, banking, and financial transactions but not as physical cash.

- The European Central Bank (ECB), established in 1998, took charge of managing the Euro’s monetary policy and overseeing the stability of the currency.

- The Introduction of Euro Banknotes and Coins (2002):

- On January 1, 2002, the Euro was introduced in physical form, with Euro banknotes and coins circulating across participating countries. This marked the culmination of the project, making the Euro tangible and usable by citizens and businesses.

- The introduction was a major logistical and symbolic achievement, with millions of people in 12 EU member states exchanging their national currencies for Euro coins and banknotes.

III. The Expansion of the Eurozone

- Initial Member States and the First Enlargement:

- Initially, the Euro was adopted by 12 EU member states: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, and the Eurozone was born.

- Over time, more countries joined the Eurozone. The first enlargement occurred in 2007, when Slovenia became the 13th member to adopt the Euro. Subsequently, other countries such as Cyprus, Malta, Slovakia, Estonia, Latvia, and Lithuania joined the Eurozone, bringing the total number of member states to 19 by 2025.

- The Criteria for Joining the Eurozone:

- To join the Eurozone, EU member states must meet specific convergence criteria, which are based on the conditions set out in the Maastricht Treaty. These criteria include:

- Price stability (inflation rate close to 2%).

- Sound public finances (budget deficit of less than 3% of GDP, and public debt of less than 60% of GDP).

- Exchange rate stability (participation in the European Exchange Rate Mechanism (ERM II) for at least two years).

- Long-term interest rates close to the EU average.

- To join the Eurozone, EU member states must meet specific convergence criteria, which are based on the conditions set out in the Maastricht Treaty. These criteria include:

- Bulgaria and Romania:

- As of 2025, Bulgaria and Romania have been progressing towards meeting the necessary criteria for Euro adoption. These countries are part of the EU but have not yet adopted the Euro due to their economic conditions and lack of compliance with the criteria.

IV. The Euro During the Financial Crisis (2008–2012)

- The Global Financial Crisis (2008):

- The global financial crisis of 2008 had significant implications for the Eurozone. Countries such as Greece, Ireland, Portugal, Spain, and Italy faced severe financial instability, leading to a sovereign debt crisis.

- The Eurozone was unable to respond quickly enough to the crisis due to the absence of a fiscal union, meaning that while monetary policy was set centrally by the European Central Bank (ECB), national governments were still responsible for their budgets and economic policies.

- The European Debt Crisis (2010–2012):

- The European Debt Crisis brought to light the vulnerabilities of the Eurozone, particularly the absence of a fiscal union and the difficulty in managing economic policies in a region with diverse economic conditions.

- In response to the crisis, the European Central Bank (ECB), along with the European Commission and the International Monetary Fund (IMF), established financial assistance programs, including bailout packages for struggling countries such as Greece.

- The European Stability Mechanism (ESM) was also created in 2012 to provide financial assistance to Eurozone countries facing difficulties.

- ECB’s Role in Crisis Management:

- The European Central Bank (ECB) played a pivotal role in managing the crisis, particularly under the leadership of Mario Draghi (President of the ECB from 2011 to 2019). In 2012, Draghi famously declared that the ECB would do “whatever it takes” to preserve the Euro, which included the implementation of quantitative easing (QE) and low interest rates to stimulate economic growth and ensure financial stability.

V. The Euro in the 21st Century and the Future of the Eurozone

- The Euro’s Global Status:

- The Euro has emerged as one of the world’s leading currencies, second only to the US dollar in global trade and financial markets. As of 2025, it is the official currency in 19 EU member states, and it is used in over 60 countries and territories globally.

- The Euro’s role as a global reserve currency has been further strengthened by its increasing use in international trade, especially in energy transactions and as a reserve asset for central banks.

- Challenges Ahead:

- The Eurozone continues to face challenges related to its economic diversity (particularly between the core and peripheral economies), as well as the ongoing debate about the need for a fiscal union to complement the monetary union.

- Issues such as Brexit (the United Kingdom’s departure from the EU) have raised questions about the future of the Eurozone, but the single currency remains resilient.

- The COVID-19 pandemic also posed new economic challenges, but the Next Generation EU recovery plan provided a framework for economic recovery, with the EU issuing joint debt to finance the response.

Conclusion

The Euro has evolved from an ambitious project aimed at deepening European integration to one of the most important currencies in the global financial system. While it has faced significant challenges—especially during the financial and debt crises—the Euro has proven to be resilient and remains a symbol of European unity and economic cooperation. As the Eurozone continues to expand and address the economic and political challenges ahead, the future of the Euro will remain a central issue in the ongoing development of the European Union.

Leave a Reply